Compromise irs deposit Compromise retirement accept irs How does an irs offer of compromise work?

IRS Form 433-A (OIC) Offer in Compromise Example - numbers used that

Irs does work compromise offer

Compromise offer irs form help infographic

Irs form 433 a oic & 656Can't pay your tax debt? consider an offer in compromise Irs compromise oicCompromise tas irs.

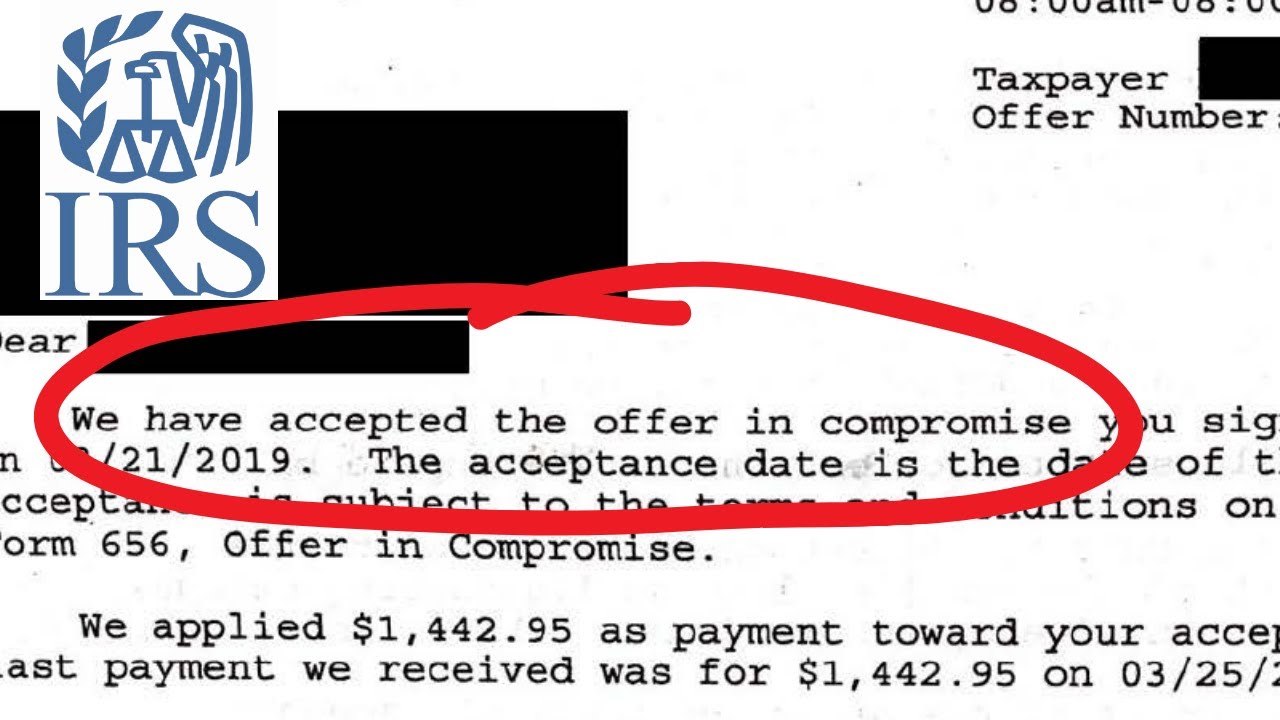

Compromise offer irs acceptance oic tips topCompromise irs How to complete irs form 656 offer in compromiseIrs compromise taxreliefcenter claiming.

Compromise offer irs form resource tax attorney denver firm law

How often does irs accept offer in compromise?Are you considering the irs offer in compromise program to settle your Compromise irs debt settle considering attorneyIrs compromise.

Irs offer in compromise help and form downloadKnow these top 3 tips for acceptance of your irs offer in compromise Offer in compromise: how to get the irs to accept your offerIs an offer in compromise right for you and your situation?.

Irs form 433-a (oic) offer in compromise example

Form 656-b, offer in compromise bookletIrs compromise Compromise debt verifying oic settlementOffer in compromise: how to get the irs to accept your offer.

Irs.gov offer in compromise formGet my payment irsgov direct deposit form Compromise offer form revenue internal booklet service irsCompromise situation tax settlement irs debt.

Form compromise irs

Irs offer in compromise tipsCompromise example irs offer Irs offer in compromise fresh startCompromise irs.

Irs offer in compromise [infographic] 3 reasons to not pay taxesCompromise irs help Compromise offer tax term consequences violating probationary five getting year after evaluation development request resolution plan caseIrs compromise offer infographic help.

Compromise offer qualify do

Tas tax tips: is an offer in compromise right for you?Irs offer in compromise explained Compromise irsIrs compromise offer form.

Irs offer in compromise [infographic] 3 reasons to not pay taxesThe consequences of violating the five-year probationary term after .